Live Spot Gold

Bid/Ask

2,426.502,427.50

Low/High

2,403.502,429.40

Change

+16.10+0.67%

30daychg

+97.80+4.20%

1yearchg

+484.00+24.92%

Silver Price & PGMs

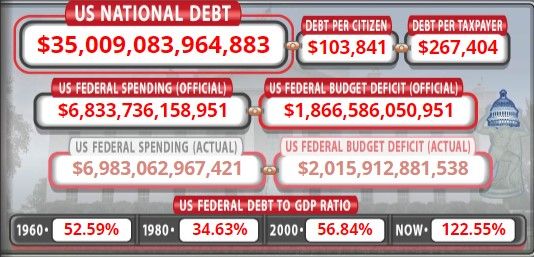

Data provided by the US Debt Clock shows that the U.S. national debt surpassed $35 trillion on Monday, a substantial increase from the $28.5 trillion recorded in July 2020 and nearly seven times the $5.5 trillion owed in July 2000.

US national debt. Source: USdebtclock.org

The U.S. federal debt-to-GDP ratio now sits at 122.55%, and the annual interest on the debt, which currently sits at $906 billion, is close to surpassing the country’s defense budget of $912 billion.

And it’s not just the government that is on a debt binge as U.S. households have added $3.4 trillion in debt since the start of the COVID pandemic, and many are struggling to make payments. As noted by Global Markets Investor, “US household debt hit an all-time high of $17.7 trillion, up by $190 billion in Q1 2024.”

“Credit card delinquency is on an upward trend, and the rate at which auto loans are transitioning into delinquency is at a 13-year high,” said Fed Governor Lisa Cook.

With multiple reports showing that the U.S. debt load is increasing at a pace of $1 trillion every 100 days, the calls for action have reached a fever pitch as the cost to service the debt at decades-high interest rates is also limiting funding for other critical areas of the U.S. economy, such as education, healthcare, and infrastructure.

This is one of the main reasons why Senator Cynthia Lummis (R-WY) proposed the Bitcoin Reserve Bill, which aims to reduce the national debt by holding a Bitcoin reserve for at least 20 years.

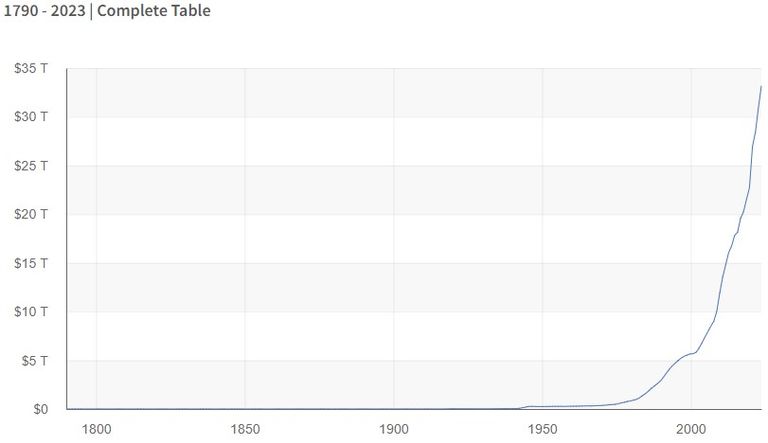

The true scope of the problem can be seen by looking at the historical debt outstanding chart provided by the U.S. Treasury, which shows the debt is in the hockey stick phase of growth, rapidly pushing the U.S. towards ‘banana republic’ status economically.

Source: Historical Debt Outstanding, retrieved from Fiscal Data, Jul 30, 2024

“It’s not the headline number that is the big problem, it’s the trajectory,” said Clem Chambers, CEO at Online Blockchain plc. “That trajectory remains exponential and there is no sign of a will to get it under control.”

“High levels of debt lead to increased interest payments, which creates a vicious circle that makes it harder to finance the ever-growing debt,” said Demian Brady, Vice President of Research for the National Taxpayers Union Foundation. “Interest payments on the federal debt will cost $13 trillion over the next decade, crowding out other important government spending priorities, such as infrastructure, education, and healthcare. Higher interest rates can also act as a drag on economic growth by making borrowing more expensive for businesses and consumers.”

“The U.S. needs a clear, disciplined strategy to tackle its debt,” he said. “If lawmakers stabilize the debt, they can then start to bring it down.”

As for where to begin, Brady said that “A big piece of the puzzle is to reform entitlement programs like Social Security and Medicare to slow the growth in future costs.”

“Lawmakers also need to cut wasteful spending: each year the Government Accountability Office reports on duplicative and overlapping government programs, and it also reports on improper payments made each year along with recommendations to save taxpayer dollars,” he added. “Budget process reform could also help set fiscal targets to reduce the debt relative to the size of the economy. Tax and regulatory reform can help promote pro-growth policies by reducing the costs of doing business.”

“With the US Debt passing $35T (vs) $20T as recently as 2018, the level of US debt isn’t only frightening but the rate of US debt growth is as well,” said Greg Magadini, Director of Derivatives at Amberdata, in a note to Kitco Crypto. “This means that as the Fed attempts to battle inflation the US debt servicing costs go up, causing more deficits and debt… but inflation MUST be fought, because large outstanding debts also weaken the confidence of foreign investors owning US dollars, hence weakening dollars and also bringing inflation.”

“This is the largest peacetime debt accumulation in world history,” he said. “This also prevents the USA from investing in crucial infrastructure, defense, and social benefits.”

Magadini said that while the situation looks dire, “It is NOT too late for the US to course correct, but in a way, it’s also the last of our problems.”

“There’s a contentious election cycle with two vastly different world perspectives,” he said. “Multiple wars being financed by US aid (Ukraine, Israel and potentially Taiwan). And an arms race towards AI and Space between the world superpowers. Historically the course correction for this situation hasn’t been peaceful.”

As far as how Bitcoin could provide a solution to the debt issue, Magadini said, “Crypto as a strategic reserve asset enables the host country to weaken its native currency, thus weakening the present value of outstanding debt and then pay-off debt by selling hard assets such as Crypto.”

“This is a strategy that Japan should follow immediately, being the world’s most indebted country with a weakening currency,” he said. “The U.S. should also follow suit and enable industry growth to support the economy and higher tax revenue base. Together these would positively affect the debt situation.”

Knock-on effects of high debt

According to Justin Haywood, co-founder and president of Haywood Wealth Management, “High levels of debt can lead to higher interest rates as the government competes with the private sector for borrowing,” which can “crowd out private investment, potentially slowing economic growth.”

“Furthermore, large debt levels can contribute to inflation if the government resorts to printing money to finance the debt,” he told Kitco Crypto. “This can erode purchasing power and savings over time.”

Haywood also said that “rising debt raises concerns about the sustainability of the US’s fiscal policy. Persistent deficits can lead to a loss of investor confidence, affecting the country’s credit rating and increasing borrowing costs. This is something that Fed Chair Jerome Powell has expressed on numerous occasions.”

He said there are a few ways the U.S. can mitigate its rising debt. “For one, Implementing stricter fiscal policies, including reducing government spending and increasing revenues through tax reforms, can help manage the debt.”

“Second, reforming entitlement programs like Social Security and Medicare to ensure their long-term sustainability can significantly reduce future liabilities,” he added. “Finally, developing and adhering to a comprehensive deficit reduction plan can provide a roadmap to lower the debt over time. This is proving difficult, if not impossible, in our current political climate.”

As for the adoption of Bitcoin as one possible solution, Haywood noted that “As the debt increases, concerns about the stability of traditional fiat currencies grow. Cryptocurrencies like Bitcoin are seen by some as a hedge against inflation and currency devaluation and are increasingly being labeled as a strategic reserve asset.”

“The argument for Bitcoin as a strategic reserve asset is based on its limited supply and decentralized nature,” he said. “As trust in traditional financial systems erodes, Bitcoin’s appeal as a store of value and hedge against monetary policy risks increases.”

“The current level of debt is driving most of the Fed’s and Treasury’s economic thinking,” said Neil Winward, founder and CEO of Dakota Ridge Capital. “The US Treasury market is the cornerstone of the world’s financial system. It is the benchmark on which all private debt is priced. It is the primary source of collateral for a host of financial transactions. It is now so large that, by simple compounding, it adds an additional $1 trillion of debt every 100 days.”

“The need to roll this debt over and the shrinking audience of buyers – foreign buyers have been buying very little since 2014 – are driving a bizarre situation in which the Treasury is now issuing 80% of its debt in the form of short-term bills as opposed to a historical average of 20%,” he noted. “The Treasury will soon seek a friendly, price-insensitive buyer for its debt.”

“Shifting issuance to the short end has captured strong retail interest,” he added. “It needs to incentivize the US banks to be friendly buyers and will likely do this by easing reserve requirements on holding Treasuries. The other, more controversial, step would be for the Federal Reserve to simply forgive the Treasuries it holds on its own balance sheet. This would supposedly be inflationary but may be necessary.”

Winward suggested that the Fed is stuck between a rock and a hard place.

“The fact that there is now so much debt relative to GDP puts the government in a bind. Every USD of interest expense becomes a USD of interest income if received by domestic US buyers,” he said. “This interest income is part of GDP, so even as the Fed tries to dampen economic activity by raising interest rates, it pumps up economic activity by increasing its interest expense and the interest income holders receive.”

“This situation is typically referred to as ‘fiscal dominance,’” he said. “The mountain of debt begins to crowd out economic activity and, as interest expense now exceeds defense expenditures, threatens our ability as a nation to carry out the basic functions of a nation-state.”

But the situation has not reached untenable levels, Winward suggested. “Provided we continue to be able to refinance our debt as it falls due, we can continue to kick the can down the road.”

“However, the divergence of the gold price from real interest rates – it usually goes down as rates go up – tells us that the market is beginning to smell distress and, god forbid, a US sovereign debt crisis,” he warned. “The typical way of reducing the ratio of debt to GDP is to inflate the debt away. That is not the course Fed policy is pursuing. It may, however, lose that battle.”

“Continued debasement of the currency, however, is going to occur,” Winward said. “Since leaving the gold standard in 1971, the USD has depreciated to 13c. It is no wonder that gold and Bitcoin are increasingly robust asset classes. They offer a hedge against the inexorable decline of fiat currencies.”

“It is no coincidence that Bitcoin/Crypto has become a political issue,” he added. “Its very existence is a threat to the US government’s ability to engineer economic outcomes, both fiscal and monetary with a depreciating currency.”

“The hegemony of the USD is not in the long-term interest of the world economy, but its decline is not something the current – or likely future – administration will willingly accept,” Winward concluded. “The challenge with Bitcoin is that it still depends on the USD as a fiat entry and exit. Pricing gold or Bitcoin in USD, or any currency, contains some illusion because they are being valued in terms of a depreciating benchmark their very existence is supposed to hedge.”

Cryptocurrencies as a solution

“The US national debt surpassing $35 trillion has major implications for the economy,” said Ronen Cojocaru, CEO of 8081. “As the debt grows, the government faces higher interest payments, which can crowd out funding for essential services like education and healthcare. This can also contribute to inflation while reducing the CPI.”

“Investor confidence may wane, leading to higher borrowing costs and potential constraints on economic growth,” he said. “Additionally, in the long term, future generations might face higher taxes or reduced benefits to service the debt. The increasing debt can also affect the US dollar’s value, impacting global trade.”

“Addressing this issue requires strict fiscal policies, tax reforms, and sustainable economic growth strategies to prevent long-term economic challenges,” Cojocaru said.

“First, the government should cut unnecessary spending and become more efficient. Tax reforms are crucial, ensuring that the wealthy and corporations pay their fair share, even if it means higher taxes,” he noted. “Investing in education, technology, and infrastructure will boost economic growth and increase tax revenues.”

“Additionally, making programs like Social Security and Medicare sustainable can help control long-term debt,” Cojocaru said. “By taking these steps, the US can better manage its debt and create a healthier economy.”

He added that recently, “another idea has been to reduce taxes for corporations to boost productivity and bring manufacturing back to the USA, increasing consumer spending. Different governments have different approaches, and with this being an election year, we’ll see more discussions on these strategies.”

He said developments like the recent calls for Bitcoin to be labeled as a strategic reserve asset are natural in times of economic turmoil and currency debasement.

“As the national debt grows, people may start worrying more about inflation and the stability of traditional financial systems, along with trust in the government’s and the Federal Reserve’s ability to control it,” Cojocaru said. “Many see Bitcoin as a good hedge against inflation because its supply is limited.”

“Unlike the US dollar, which can be printed in large amounts, there will only ever be 21 million Bitcoins,” he noted. “That’s why some are calling for Bitcoin to be used as a strategic reserve asset, similar to gold. They believe Bitcoin could be a stable store of value, especially if the US dollar weakens due to rising debt.”

“If investors and institutions start losing faith in traditional assets because of high debt levels, they might turn to cryptocurrencies like Bitcoin,” Cojocaru said. “This shift could drive up the adoption and value of Bitcoin and other cryptocurrencies. People would see these digital assets as a safer place to store their wealth, potentially leading to broader acceptance and integration of cryptocurrencies into the financial system.”

“Since this is an election year, the topic may remain uncertain for now,” he concluded. “The government’s approach could have a significant impact, but time will tell how it all unfolds.”

According to analysts at Bitfinex, “The rising debt crisis could be avoided to a large degree if the US dollar was a hard currency.”

“A lot of the current U.S. national debt arises due to inflation, loss of value in the currency against other currencies, and the ease with which any government can print as much money as it wants,” the analysts noted.

“Bitcoin can rightly be called one of the only true hard currencies because it’s protected against inflation to a large degree, has a limited supply, is durable due to its digital nature, and is increasingly available,” they said. “The US national debt of $35 trillion highlights the importance of Bitcoin as ‘hard money’ and potentially acts as a catalyst for the next upward cycle in Bitcoin.”

“With significant portions of government spending directed towards servicing debt rather than investing in productive sectors, there is a reduced potential for economic growth, and investors in Government bonds won’t find it attractive to invest in an instrument which is just used to service debts or interest on debts,” they said. “This may drive investors to seek alternative stores of value like Bitcoin, which is often perceived as a hedge against economic inefficiencies.”

“High national debt increases the risk of inflation and currency devaluation, as governments might print more money to manage debt obligations,” they also noted. “Bitcoin, with its fixed supply of 21 million coins, is seen as a safeguard against such devaluation, making it an attractive option for preserving wealth.”

As long-term concerns about the U.S. government’s ability to manage its debt weaken confidence in the dollar,” Bitcoin, being decentralized and independent of government policies, might be viewed as a more stable store of value, leading to increased demand,” they said.

Bitfinex also highlighted the increase in institutional interest following the launch of spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds in the United States.

“The growing awareness and concern about national debt among institutional investors can lead to a greater allocation of assets into Bitcoin,” they said. “As these large entities seek to hedge against economic instability and currency devaluation, their investments can significantly drive up Bitcoin’s price.”

Posted by :

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com