SPOT MARKET IS OPEN (WILL CLOSE IN 6 HRS. 20 MINS. )

Live Spot Gold

Bid/Ask

2,416.202,417.20

Low/High

2,382.202,420.30

Change

+44.80+1.89%

30daychg

+248.60+11.47%

1yearchg

+379.00+18.60%

Silver Price & PGMs

The Wall Street Journal reports Israel is set for another assault against Iran following an air strike on an Iranian compound last week. Meantime, Iran has threatened retaliation, and said it may block the important Strait of Hormuz, a vital global shipping route. The Russia-Ukraine war is still running hot, too.

Precious metals bulls have been impressed with gold and silver rallying despite higher bond yields. Broker SP Angel said in a morning email dispatch that Bloomberg reported Chinese gold ETFs have seen huge inflows, with some up 40% since the end of March. “Chinese investors are rushing to safe- haven assets as their property sector continues to slump and their equity market fares little better. China’s Yuan remains under pressure, with the PBoC continuing to fix the currency onshore at 7.1 per dollar,” said the broker. Central banks are also reported to be snapping up gold.

Asian and European stock indexes were mixed to lower overnight. U.S. stock indexes are pointed to toward lower openings when the New York day session begins. The U.S. stock indexes have turned wobbly this week after a hotter U.S. consumer price index report on Wednesday. Reads a Wall Street Journal headline today: “Fed rate cuts are now a matter of if, not when.”

The key outside markets today see the U.S. dollar index solidly higher and at a 5.5-month high. Nymex crude oil prices are higher and trading around $86.25 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently fetching 4.53%.

U.S. economic data due for release Friday includes import and export price indexes and the University of Michigan consumer sentiment survey.

Technically, the gold futures bulls have the strong overall near-term technical advantage. A seven-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close in June futures above solid resistance at $2,500.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at today’s contract high of $2,418.20 and then at $2,435.00. First support is seen at the overnight low of $2,388.60 and then at $2,350.00.

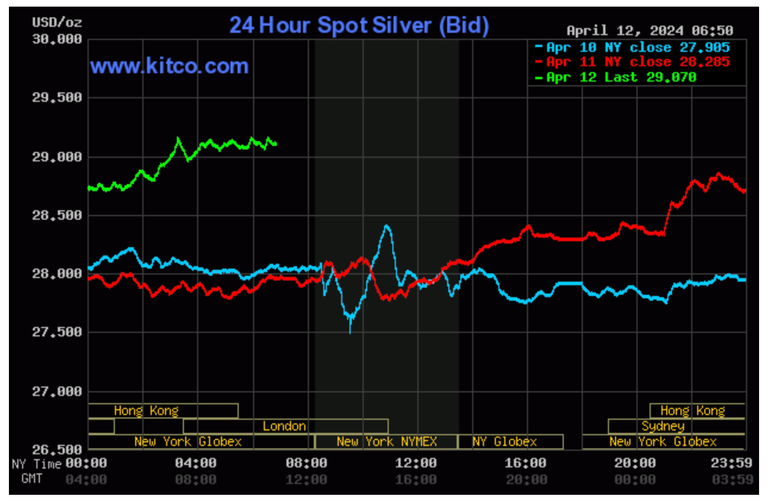

The silver bulls have the strong overall near-term technical advantage. Prices are in a two-month-old uptrend on the daily bar chart. Silver bulls’ next upside price objective is closing May futures prices above solid technical resistance at $30.00. The next downside price objective for the bears is closing prices below solid support at $27.00. First resistance is seen at the overnight high of $29.315 and then at $29.50. Next support is seen at the overnight low of $28.485 and then at $28.00.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@ gmail.com