Live Spot Gold

Bid/Ask

2,714.902,715.90

Low/High

2,691.502,720.80

Change

+22.40+0.83%

30daychg

+145.90+5.68%

1yearchg

+759.80+38.86%

Silver Price & PGMs

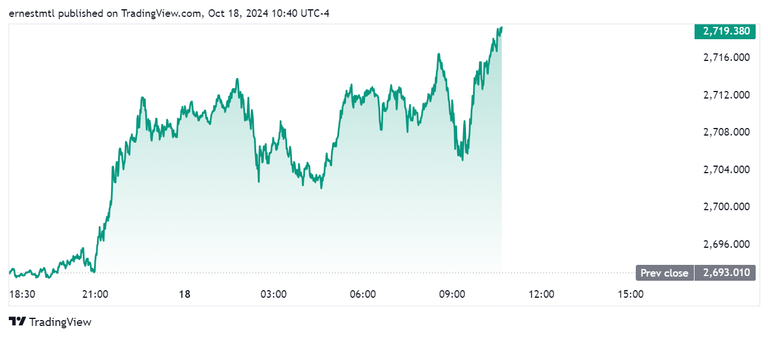

(Kitco News) – Gold prices spiked to fresh record highs, driven by concerns over escalating tensions in the Middle East and uncertainty surrounding the U.S. election, according to commodities analysts at ING.

“Traders are seeking safety in gold this morning after Israel said it killed Hamas leader Yahya Sinwar, and Prime Minister Benjamin Netanyahu said Israel would keep fighting until all the hostages seized by Hamas last year are free, even though US President Joe Biden said it was time for the war to end,” wrote commodities strategist Ewa Manthey and head of commodities strategy Warren Patterson in a Friday morning update.

ING noted that gold is one of this year’s strongest performing commodities in 2024, gaining over 30% so far this year, supported by rate-cut optimism, central bank buying, and strong Asian demand.

“Safe-haven demand amid heightened geopolitical risks as well as uncertainty ahead of the US election in November have also supported gold’s record-breaking rally this year,” the analysts said. “We believe the macro picture combined with safe-haven demand amid an escalation of tensions in the Middle East and the ongoing war in Ukraine will drive gold to new highs.”

They believe the momentum from the U.S. presidential election will continue to drive gold prices higher right through to the end of the year, regardless of which party emerges victorious. “Central banks are also expected to keep adding to their holdings, which should offer support,” the analysts said.

Peter Schiff was quick to jump on the new high, posting to X on Thursday evening that this is further proof of his long-term bullish case for gold.

“Not only is #gold trading at yet another record-high tonight, but it’s trading at $2,707, above $2,700 for the first time ever,” Schiff wrote. “We are still early in what will likely be the mother of all gold bull markets. Even if you wait for $4,000 to buy, it will still be early. But why wait?”

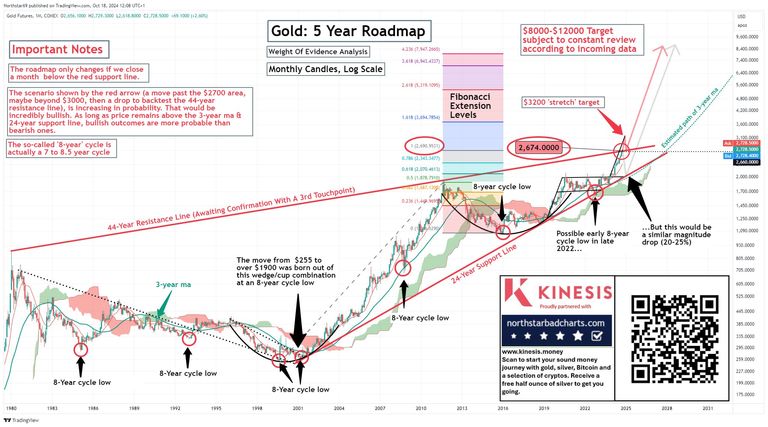

Technical analysts were also unpacking the implications of gold’s new highs, with some warning of a near-term pullback before the yellow metal resumes its upward trajectory.

“Can we turn $2700 from monthly resistance into support, before we see a correction of 15-20%?” asked precious metals analyst Northstar in an X post. “If so, the ‘stretch target’ is probable.”

Technical analyst Patrick Karim was looking at gold’s gains relative to silver prices, and shared what he called “An unpopular fact.”

“Historically, the gold to silver ratio has been trending upwards, not downwards,” Karim wrote. “It is actually close to a huge breakout, rather than a huge breakdown.”

“We could see this ratio go higher than 1 to 175 if this happens!” Karim said.

Legendary trader Peter Brandt also noted gold’s divergence from silver prices, but said the gray metal’s time will come.

“The Silver bulls are crying ‘no fair’ that Gold (a precious metal) is outperforming Silver (primarily an industrial metal),” Brandt wrote. “Ultimately Silver will have its day in the sun, but no reason the $GC_F / $SI_F ratio cannot know go to 90 to 1, even 95 to 1.”

Spot gold continues to post new record highs on Friday morning, last trading at $2,719.32 for a gain of 0.98% on the daily chart.

Posted by:

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com