SPOT MARKET IS OPEN (WILL CLOSE IN 3 HRS. 35 MINS. )

Live Spot Gold

Bid/Ask

2,415.202,416.20

Low/High

2,369.602,425.60

Change

+44.50+1.88%

30daychg

+105.80+4.58%

1yearchg

+459.60+23.50%

Silver Price & PGMs

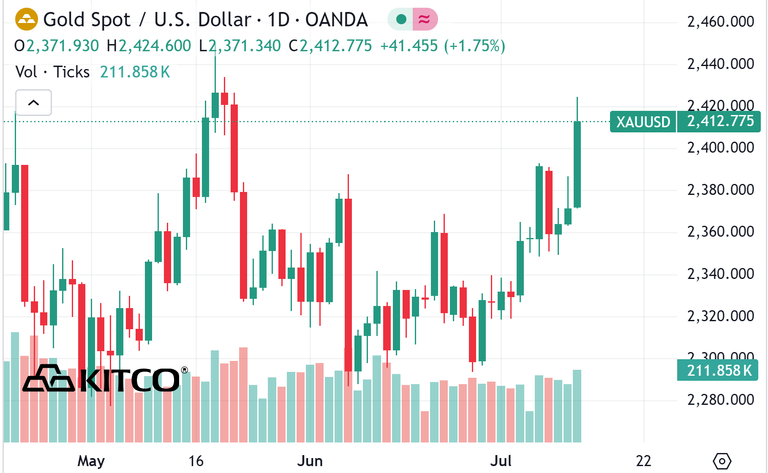

Today’s June U.S. consumer price index saw a rise of 3.0%, year-on-year. June CPI was forecast coming in at up 3.1% and compares to the May report reading of up 3.3%. The “core” CPI (excluding food and energy) was up 3.3% annually and compares to forecasts for up 3.4% and compares to up 3.4% seen in the May report. The U.S. producer price index report for June is out on Friday morning.

A few analysts are even thinking the Fed could cut U.S. interest rates at its next FOMC meeting on July 30-31. The key outside markets today see the U.S. dollar index solidly lower and hitting a four-week low. Nymex crude oil prices are a bit higher and trading around $82.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently 4.177% and down in the wake of the tamer CPI report.

Technically, August gold bulls have the solid overall near-term technical advantage and gained more power today. Bulls’ next upside price objective is to produce a close above solid resistance at the May contract high of $2,477.00. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at the June low of $2,304.20. First resistance is seen at today’s high of $2,430.40 and then at $2,450.00. First support is seen at $2,400.00 and then at today’s low of $2,376.80. Wyckoff’s Market Rating: 7.5.

September silver futures bulls have the solid overall near-term technical advantage. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the May high of $33.05. The next downside price objective for the bears is closing prices below solid support at $30.00. First resistance is seen at today’s high of $32.015 and then at $32.50. Next support is seen at $31.00 and then at this week’s low of $30.71.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com