SPOT MARKET IS OPEN (WILL CLOSE IN 5 HRS. 46 MINS. )

Live Spot Gold

Bid/Ask

2,430.502,431.50

Low/High

2,405.602,434.50

Change

+4.60+0.19%

30daychg

+39.30+1.64%

1yearchg

+458.50+23.25%

Silver Price & PGMs

(Kitco News, Tues. May 21st, 2024) – Gold prices may be benefiting from U.S.-China trade tensions and rising Indian seasonal demand, while the subcontinent’s solar buildout is also expected to boost silver demand, according to precious metals analysts at Heraeus.

The analysts wrote that gold’s recent rally was propelled by a weaker U.S. dollar and a pullback in yields following an improved U.S. inflation outlook.

“Last Wednesday’s report of US inflation data for April showed CPI and core CPI decelerating, rising 3.4% and 3.6% year-on-year, respectively,” they said. “Also helping the uptick in gold are the decline of Treasury yields and a weaker dollar, two conducive factors to gold’s appeal to international investors.”

Heraeus believes gold prices may also have benefited from the ratcheting up of trade tariff threats against China. “On Tuesday, the US officially proposed maintaining – and increasing some – Section 301 tariffs on Chinese imports,” they said. “The Biden administration may be trying to gain an election advantage by outdoing Trump in its targeting of China.”

The analysts also suspected that Indian gold purchases around the May Akshaya Tritiya festival. “Discounts of Indian gold to the international price have notably narrowed from $17.3/oz in April to $1.9/oz over the first two weeks in May, implying robust demand in the local market,” they said.

Spot gold posted a record-high close of $2,408 per ounce last week, and the strength continued through the weekend, topping out just below $2,450 per ounce early Sunday morning. Spot gold last traded at $,2426.28 per ounce at the time of writing, and is hovering around flat on the session.

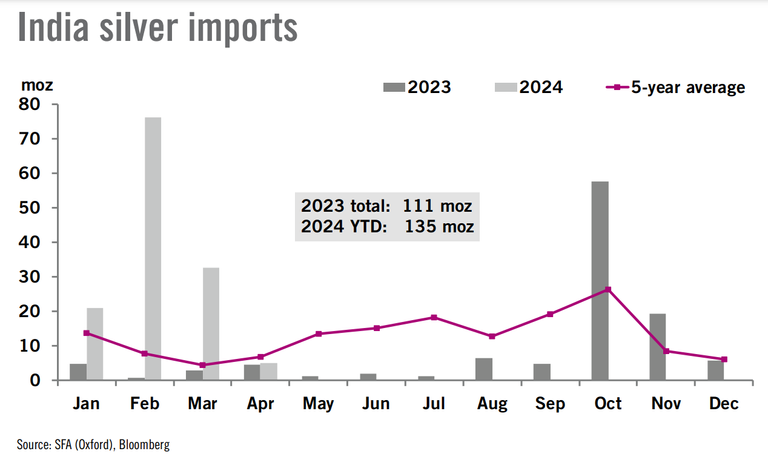

Turning to silver, the analysts noted that India imported more of the gray metal in Q1 2024 than in all of 2023, and they see Indian demand as a major contributor to price appreciation for the rest of the year.

“India had very strong silver purchases in Q1’24, with imports reaching ~3,730 tonnes,” they said.

“India’s silver imports may be bolstered by efforts to localise solar supply chains, especially in the cell manufacturing sector, as it is a conductive medium in solar cells,” the analysts wrote. “This is in addition to the traditionally large sectors of jewellery and silverware fabrication. At the end of 2023, India maintained a module capacity of 64.5 GW but a cell production capacity of only 5.8 GW, a notable lag in the midstream sector.”

Heraeus said that “cell projects in the pipeline, growing restrictions on Chinese imports, and an ambitious energy transition underway could all significantly lift India’s demand for silver paste,” and noted that India already had 81 GW of cumulative solar installations at the end of Q1, “while multiple forecasts suggest it is on track to hit 500 GW by 2030.”

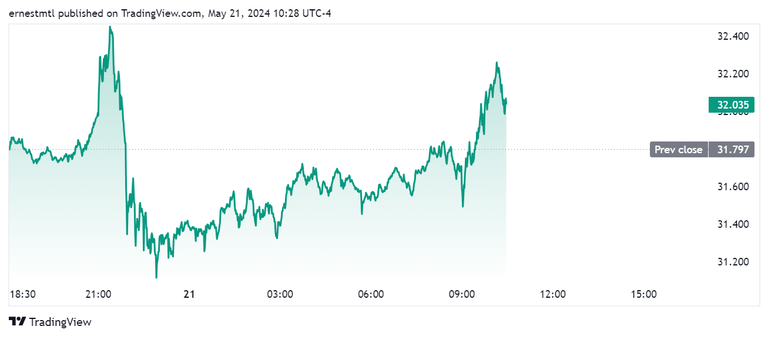

Spot silver also enjoyed a strong rally last week, with Friday’s weekly closing price of $30.63 per ounce the highest in more than 11 years. “Silver appears to be finally playing catch up to gold,” they said. “Year-to-date, silver has now outperformed gold with an appreciation for the yellow metal. As a result, the gold:silver ratio has fallen sharply.”

Silver has held comfortably above the $30 per ounce level since Friday, with spot silver last trading at $32.035 per ounce, up 0.72% on the session.

Posted by :

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com