SPOT MARKET IS OPEN (WILL CLOSE IN 4 HRS. 50 MINS. )

Live Spot Gold

Bid/Ask

2,344.902,345.90

Low/High

2,339.102,384.20

Change

-33.10-1.39%

30daychg

+21.40+0.92%

1yearchg

+385.20+19.66%

Silver Price & PGMs

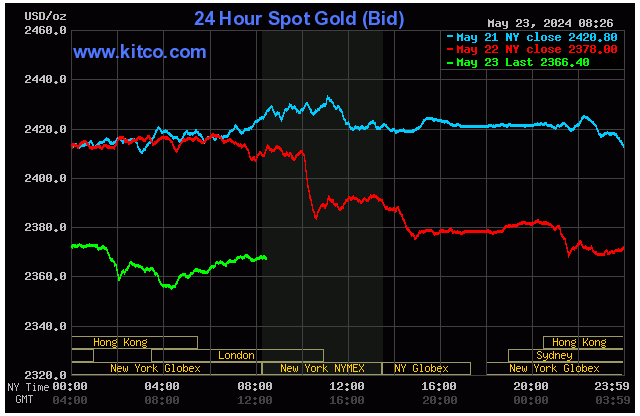

(Kitco News, Thurs. May 23rd, 2024) – Gold and silver prices are lower in early U.S. trading Thursday, on more profit-taking pressure from the shorter-term futures traders as well as weak-handed longs being forced to liquidate their recently established positions that are now under water. Slightly more hawkish FOMC minutes released Wednesday afternoon are also weighing on the precious metals markets. Gold market bulls are also worried about a potentially bearish chart pattern that has just formed. June gold was last down $22.00 at $2,370.90. July silver was last down $0.601 at $30.895.

Wednesday afternoon’s FOMC minutes from the last Fed monetary policy meeting leaned just a bit more hawkish than the marketplace expected. While the markets expected a “higher for longer” U.S. interest rate theme from the minutes, what the markets did not expect was that several FOMC members indicated they were willing to raise interest rates should inflation risks accelerate. The U.S. stock indexes saw selling pressure after the minutes were released and U.S. Treasury yields up-ticked a bit.

Asian and European stock indexes were mixed overnight. U.S. stock indexes are pointed toward higher openings and new record highs when the New York day session begins. Strong quarterly earnings from Nvidia and reports of a News Corp. deal with OpenAI are fueling gains in the stock market today.

In overnight news, the Eurozone got some upbeat manufacturing and services purchasing managers indexes (PMI)for April, as both beat market expectations. However, the manufacturing PMI reading was 47.4, which is still well below the 50.0 reading that suggests the sector is still in contraction.

A Barrons story today has a headline that reads: “Commodities are hot….” The story says “Commodities are having their moment. Gold and copper have hit historic highs while agriculture is knocking on the door to join the party.” The story continues, saying “bottom line, the commodity bull market is alive and well and has more upside.”

The key outside markets today see the U.S. dollar index lower. Nymex crude oil prices are firmer and trading around $78.25 a barrel. The yield on the benchmark 10-year U.S. Treasury note is fetching 4.43%.

U.S. economic data due for release Thursday includes the weekly jobless claims report, the Chicago Fed national activity index, the U.S. flash manufacturing and services purchasing managers indexes (PMIs), new residential sales and the Kansas City Fed business survey.

Technically, the gold futures bulls have the firm overall near-term technical advantage. However, there is now the specter of a bearish double-top reversal pattern forming on the daily bar chart. Bulls’ next upside price objective is to produce a close in June futures above solid resistance at the record high of $2,454.20. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at the overnight high of $2,385.70 and then at $2,400.00. First support is seen at the overnight low of $2,356.80 and then at $2,350.00.

The silver bulls have the solid overall near-term technical advantage. Prices are in a three-week-old uptrend on the daily bar chart. Silver bulls’ next upside price objective is closing July futures prices above solid technical resistance at this week’s high of $32.75. The next downside price objective for the bears is closing prices below solid support at $30.00. First resistance is seen at the overnight high of $31.185 and then at $31.50. Next support is seen at the overnight low of $30.36 and then at $30.00.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com