Live Spot Gold

Bid/Ask

2,656.702,657.70

Low/High

2,643.702,663.90

Change

-7.30-0.27%

30daychg

+156.40+6.26%

1yearchg

+748.80+39.25%

Silver Price & PGMs

(Kitco News, Wed. Oct. 2nd, 2024) – Gold continues to dominate the global currency market, hitting record highs across the board; however, the precious metal also continues to demonstrate its value in the real world.

Last week, the European-based investment firm Incrementum AG published its annual iPhone/gold ratio, which underscores how gold continues to maintain its value.

The firm noted that for the third year in a row, the cost of an iPhone priced in gold bullion has dropped. According to the unique ratio, the iPhone 16 Pro with 1 TB of memory costs 0.60 ounces of gold, which is 23% less than last year’s 0.78 ounces of gold for the iPhone 15 Pro.

“Compared to 2022, the price of an iPhone measured in gold fell by almost a third, and compared to 2018, this year’s iPhone is almost 50% cheaper. 2018 was the only year a gold investor had to spend more than 1 ounce of gold for a brand-new iPhone,” the analysts said.

Priced in U.S. dollars, the cost of the latest iPhone has remained unchanged for the last three years.

“But stable prices are definitely different from falling prices,” the report noted. “As in 2021, 2022, and 2023, the price of the Pro model with the largest available storage (1 TB) is USD 1,499. Compared to the very first iPhone, which was launched in 2007 for USD 599, the price has increased by 150%. This corresponds to an annual iPhone inflation rate of 5.5%. Gold investors, on the other hand, benefit from the fact that the price of gold has risen by almost 290% during the iPhone era.”

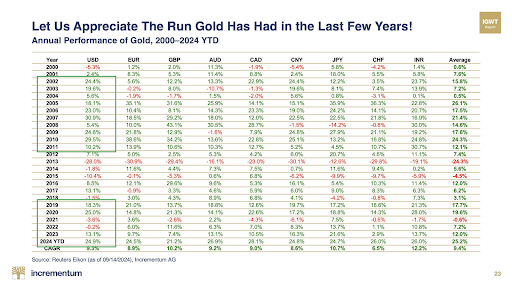

Gold has managed to maintain its purchasing power, achieving broad-based gains and reaching all-time highs against major currencies like the euro, the British pound, the Canadian dollar, and the Australian dollar.

Incrementum’s latest research shows that gold prices are up roughly 25% so far this year against a basket of global currencies.

Although gold prices encountered some resistance at all-time highs above $2,680 an ounce last week, many analysts expect the precious metal still has plenty of upside as the Federal Reserve now leads central banks in a global interest rate easing cycle.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com