Per the latest COT report (note: this references the August 21st COT Report), the hedge fund (Managed Money) net short position in Comex paper gold was 90,000 contracts – by far a record short position for the hedge fund trader category. Conversely, the bank net long position (Swap Dealers) in Comex paper gold was close to an all-time high. It’s not quite as high it was in December 2015.

The hedge fund long position in US dollar futures is also at an extreme right now, with the banks taking the other side. Unless there’s something devious going on behind the scenes in the reporting of this data (possible but not probable), the banks are positioned for a huge move higher in gold and a sell-off in the dollar. The only question is timing. The commercial category of the COT Report (banks + producers/merchants/processors/users) is net long silver futures for the first time in at least 25 years. In combination with the gold COT Report structure, this is the most bullish set-up for the precious metals in history.

Note: Per the latest COT Report, positions as of August 28th, the hedge funds reduced their net short by 16,000 contracts and the banks reduced their net long by 2,700 contracts. The hedge fund covering explains why the price of gold rose roughly $20 between August 21st and August 28th.

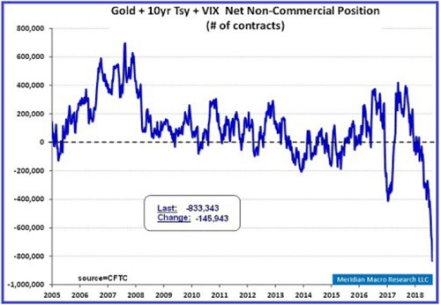

The chart below illustrates the extreme positioning by speculators in gold, interest rates and the stock market:

The graphic shows the net short position of non-commercials (managed money, other institutional pools of investment money and retail traders) in gold futures, 10yr Treasury futures and VIX futures. It’s the largest bet in history by speculators that gold and 10yr Treasury bonds will go a lot lower and the stock market will go a lot higher (volatility declines as stocks rise, so a short-VIX bet is a bet stocks go higher).

When positioned at an extreme like this, speculators are always wrong. It may not seem like it right now, but I would also suggest some type of development is percolating that will trigger an unexpected and substantial sell-off in the dollar.

Based on looking at the increase in the hedge fund net short position in the gold futures COT report between the end of June and the latest report as of August 21st, it would appear as if most hedge fund short-interest contracts were sold short between July 31st and August 21st. During that stretch, the price of gold dropped from $1224 to $1170. I’m guesstimating that the average price on the hedge fund net short position is between $1215 and $1220. This is a rough estimate but I would bet it’s pretty close.

This is important because it tells us the price level at which we might see a big short cover move higher begin. Last Friday gold shot up from $1194 to $1212. From this past Monday (August 27th) through Tuesday just before the Comex floor opened, gold ran up close to $1221. About an hour into the Comex floor hours, gold fell off a cliff quickly down to $1207. This price-hit occurred in the absence of any news or events that would have triggered a selloff. In fact, the yuan rose sharply vs. the dollar on Tuesday, which throws cold water on the theory that the Chinese have pinned gold to the yuan.

The point here is that the hedge funds will be motivated to defend the $1220 price level. Above that price, the hedge funds will start to lose a lot of money on their net short position. This is the only way I can explain the waterfall hit on the price of gold on Tuesday. If the price of gold can climb over $1220 toward $1230, it will likely trigger a short-cover move. But keep in mind that, as the price momentum heads higher, the hedge fund position will swing from net short to net long.

This is likely what will drive the start of the next move higher in gold. A move that will be reinforced by the start of the big seasonal buying season in India and China. Based on the numbers I see on a daily basis, the Indians and the Chinese are taking advantage of the lower price of gold and have already ramped up their gold buying. When the Fed is forced by the economy to fold on rate hikes, gold will really begin to move.