SPOT MARKET IS OPEN (WILL CLOSE IN 4 HRS. 26 MINS. )

Live Spot Gold

Bid/Ask

2,028.702,029.70

Low/High

2,028.702,029.70

Change

-16.60-0.81%

30daychg

+24.20+1.21%

1yearchg

+163.00+8.74%

Silver Price & PGMs

(Kitco News, Mon. Jan. 8th, 2024) – The gold market remains stuck in neutral territory above $2,000 an ounce; however, one research firm says that gold remains an important hedge against inflation and financial market risks, and the precious metal is set to rally as the year progresses.

In their 2024 outlook forecast, analysts at BCA Research said that they expect gold prices to rally to $2,200 this year. While many gold investors continue to watch the Federal Reserve for signs of easing, the analysts at BCA said that there are plenty of other factors to support elevated gold prices in the new year.

Looking at U.S. monetary policy, BCA expects that the Federal Reserve will ease interest rates slower than markets expect. Currently, the central bank has signaled three potential rate cuts this year, while the CME FedWatch Tool shows markets see the Fed Funds rate falling below 4.00% by the end of the year.

At the same time, BCA does not expect higher-for-longer interest rates to push the economy into a recession, even if activity slows. The Montreal-based research firm said falling inflation pressures and healthy wages should drive real consumption, supporting economic activity.

“Wages have increased post-pandemic. As a result, households will see their purchasing power increase – i.e., real disposable income will rise,” the analysts said. “This should persist over the short run, even as the number of unemployed persons per job opening appears to be returning to pre-pandemic levels from rates almost twice those seen prior to COVID-19.”

Although inflation is expected to fall, BCA said that it is unlikely to hit the central bank’s target of 2%, which will make gold an attractive long-term inflation hedge. At the same time, growing government debt, geopolitical uncertainty and shifting globalization trends are expected to support long-term inflation, the analysts said.

“Rising federal debt remains a medium-to-long-term inflation risk, as it increases the odds the Fed will be forced into a fiscal-dominance operational mode,” they said. “Global economic fragmentation remains an inflation risk over the medium-to-long term because it will weaken well-developed supply chains and make resource allocation more inefficient.”

The analysts also expect geopolitical uncertainty to support gold’s safe-haven appeal through 2024. They said that the green energy transition and the race to secure the raw materials to meet long-term goals will tighten geopolitical tensions globally.

“Tensions in the Middle East, Eastern Europe and the East and South China seas remain elevated, and will increase. This, too, is an inflation risk, as wars persist and the prospect of wider kinetic engagements rises,” the analysts said.

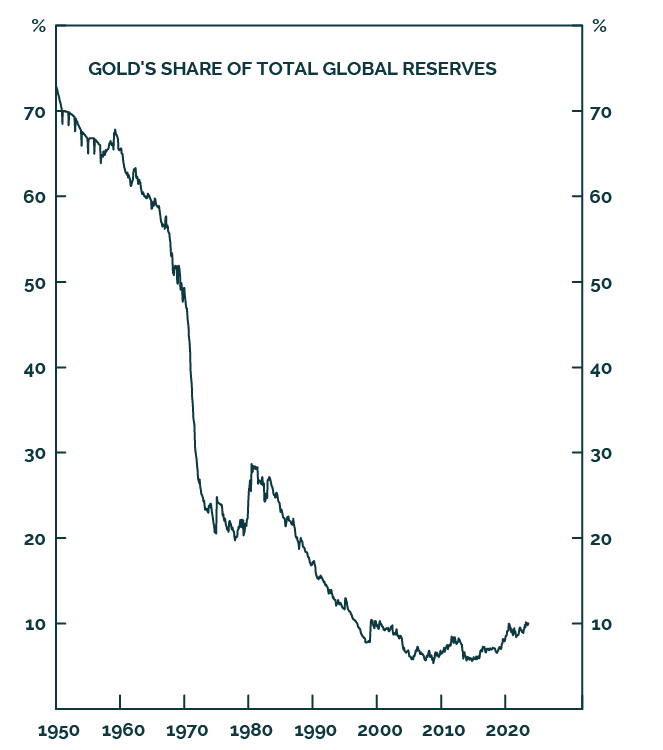

The final factor supporting gold prices through 2024 is continuing robust central bank demand. The analysts noted that heightened geopolitical tensions will put pressure on the U.S. dollar as the world’s reserve currency, making gold an attractive monetary metal.

“As [the] world splits into East-West trading blocs, the continuing trend of trade fragmentation will challenge the need for a USD-centric monetary system, and will see CBs turn to gold as a safe haven amidst rising global economic policy uncertainty,” the analysts said.

BCA has been long gold since November 2022 and is seeing a more than 15% return on the trade.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com