SPOT MARKET IS OPEN (WILL CLOSE IN 4 HRS. 54 MINS. )

Live Spot Gold

Bid/Ask

2,327.902,328.90

Low/High

2,315.702,334.60

Change

+7.90+0.34%

30daychg

-5.40-0.23%

1yearchg

+407.70+21.23%

Silver Price & PGMs

(Kitco News, Mon. June 24th, 2024) – The gold market may be treading water now, but it is expected to ride a wave significantly higher as the Federal Reserve cuts interest rates later this year and rising debt further fuels economic uncertainty, according to Bank of America.

In a report published Monday, Michael Widmer, commodity strategist at the bank, said that he sees the potential for gold prices to hit $3,000 an ounce in the next 12 to 18 months. However, he added that the market needs to see a pickup in investment demand, which is unlikely to happen until the Federal Reserve gives a clear signal that it is ready to cut interest rates.

“If non-commercial demand picks up from current levels on the back of the Fed rate cut, the yellow metal could push higher again. Beyond inflows into physically-backed ETFs, a pickup in LBMA clearing volumes would be an encouraging signal,” Widmer said in the report. “A gold price average of $2,500/oz this year could be justified if investment demand increased by around 20%. Yet, non-commercial purchases were up by only around 3% YoY in 1Q24, enough to justify an average gold price of just $2,200/oz YTD.”

Looking beyond U.S. monetary policy, Bank of America sees rising bond yield volatility as another tailwind for gold. Widmer noted that gold remains an attractive reserve asset as central banks worldwide reduce their exposure to the U.S. dollar and Treasuries.

The report noted that China is the dominant force in both the gold market and Treasuries.

“China has been the biggest official gold buyer in recent years, while the share of USD in its portfolio has declined. Indeed, the PBoC has been steadily diversifying its foreign reserves, with gold holdings increasing by 8Moz, equivalent to $51bn, since January 2023, lifting the share of the yellow metal in total reserves from 3.5% in December 2022 to 4.9% in April 2024,” Widmer said. “At the same time, the data shows that China’s holdings of U.S. Treasuries (UST) dropped by $102bn in the past 12 months to a 25-year low of $767bn in March 2024.”

Although a breakdown in U.S. Treasuries is not the bank’s base-case scenario, it did warn that risks in the global economy are rising and the U.S. bond market looks fragile. The analysts warned that the U.S. Treasury market is one shock away from not functioning seamlessly.

The analysts said that the biggest problem is that rising government debt has meant market makers have not been able to keep up with the growing supply of bonds, which is creating some illiquidity in the marketplace. Bank of America noted that the U.S. Treasury market has doubled in size every seven years since 2001.

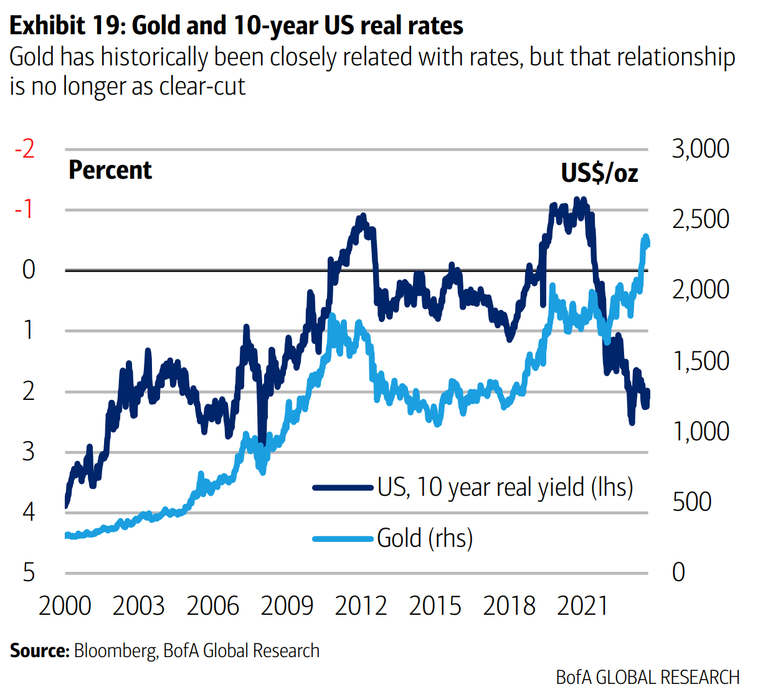

“Increased macro uncertainty today may pose an even greater threat to market stability in a context where growth in government debt has vastly overwhelmed the intermediation capacity of the market,” Widmer said. “Looking at the UST tail risk, how could this actually play out? In our view, a sharp move higher in rates would initially be accompanied by lower gold prices. That said, the search for a ‘safe-haven’ asset will ultimately divert flows into the gold market, so the yellow metal will then likely pick up. The long-standing inverse relationship between gold and rates has become more tenuous already and, in our view, this is unlikely to change going forward.”

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com