SPOT MARKET IS OPEN (WILL CLOSE IN 3 HRS. 40 MINS. )

Live Spot Gold

Bid/Ask

2,308.002,309.00

Low/High

2,296.902,320.50

Change

-2.20-0.10%

30daychg

-51.70-2.19%

1yearchg

+352.20+18.01%

Silver Price & PGMs

Stocks fell under pressure in early trading but managed to climb back into the green in the afternoon despite rising expectations that the Fed will keep interest rates at a two-decade high for longer. The CME FedWatch tool now shows that anticipation for a September rate cut has fallen to 49%, down from 60% a week ago.

Geopolitical developments in Europe also have investors on edge after France’s President Macron and German Chancellor Olaf Scholz suffered lopsided losses to far-right parties in European elections on Sunday. The euro fell to its lowest level in a month after the results were released, while the Paris stock index sank around 2% in the wake of Macron announcing snap elections.

At the market close on Monday, the S&P, Dow, and Nasdaq were all in the green, up 0.26%, 0.18%, and 0.35%, respectively.

Data provided by TradingView shows that Bitcoin (BTC) briefly spiked back above $70,000 in early trading to hit a high of $70,195, but gave back the gains in the afternoon and returned to support near $69,600.

BTC/USD Chart by TradingView

At the time of writing, Bitcoin trades at $69,640, an increase of 0.05% on the 24-hour chart.

Short-term leverage flush

“Highly positive ETF flows for the last 20 trading days have helped to offset pressure on BTC, however, the fact that this was unable to move the price further, and push BTC above its range high is a negative in the short-term,” said analysts at Bitfinex. “The counter-argument is that traders are executing a basis arbitrage trade, where they have long spot exposure and short perpetual futures to collect funding payments.”

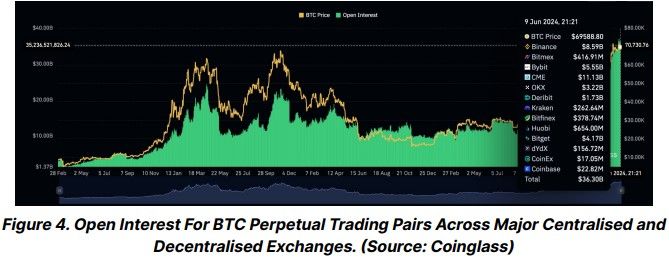

“However, it is important to note that this is highly speculative,” they added. “As per the chart below, there has been high open interest (OI) on BTC, as well as on altcoins.”

“Coinglass data shows that BTC OI across major exchanges reached an all-time high of $36.8 billion on June 6th,” they said. “And despite [Friday’s] correction in price, OI is currently sustained above $36 billion levels.”

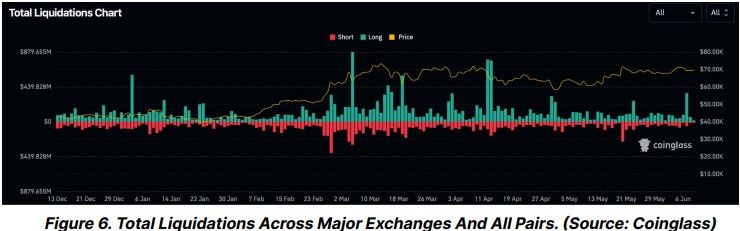

“We believe the drop on Friday was more of a ‘leverage flush’ where an extreme amount of leveraged longs on altcoins (as well as majors to some extent) is wiped out and funding rates neutralised,” the analysts suggested. “However, we do not expect a major decline to follow immediately, even though the leverage wipeout/liquidations were quite significant on altcoins.”

“This is mainly because the amount of BTC liquidations was relatively small,” they said. “While we had more than $360 million in long liquidations and over $410 million total liquidations on June 7th – the highest since April 14th and more than when BTC went sub $57,000 – this time around only $50 million of the long liquidations came from BTC.”

“Most were on altcoins, which explains the severity of the decline in altcoins last week relative to majors,” the analysts said. “Such liquidation events are usually not followed by further severe drops and hence the next week will be pivotal, given the forthcoming Consumer Price Index inflation report on June 12th is expected to be a major market catalyst, with the price expected to continue to range in a tight environment as derivatives positions get built up again.”

“In the current environment, holding the local lows around $68,000-$68,500 would be pivotal for bulls, whereas failure to move past range highs remains a cause for concern,” the analysts said.

Addressing the tough situation the Fed finds itself in regarding interest rates, Bitfinex analysts said keeping rates higher for longer is a double-edged sword that will need to be navigated with deftness.

“On one hand, the strength and adaptability of the US economy could enable it to thrive even in a high-interest-rate environment driven by robust labour demand and rising wages,” they said. “This scenario would support continued economic growth, solid consumer spending, and overall economic resilience.”

“However, there is also a significant risk that maintaining elevated interest rates for too long could stifle economic activity, leading to reduced investment, slower job creation, and a potential downturn,” they warned. “The Fed faces the delicate task of balancing these opposing outcomes.”

They also suggested that the recent rate cuts by the European Central Bank and the Bank of Canada, done to “shift towards more accommodative monetary policies to boost economic growth, suggest that the Fed may need to re-evaluate its own monetary policy.”

“With the Fed adopting a cautious approach, the actions of its global counterparts may influence its decisions in the coming months, particularly if inflation trends and economic conditions warrant a shift,” they said.

Altcoins struggle to regain momentum

It was a red start to the week for altcoins as 90% of the tokens recorded losses on Monday.

Daily cryptocurrency market performance. Source: Coin360

(POLYX) was the top gainer with an increase of 9.7%, followed by gains of 8.6% for Gnosis (GNO) and 5.5% for Livepeer (LPT). Wormhole (W) was the biggest loser after plunging 18%, while Biconomy (BICO) lost 17.1%, and Echelon Prime (PRIME) fell 10%.

The overall cryptocurrency market cap now stands at $2.53 trillion, and Bitcoin’s dominance rate is 54.1%.

Posted by :

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com