SPOT MARKET IS OPEN (WILL CLOSE IN 4 HRS. 7 MINS. )

Live Spot Gold

Bid/Ask

2,317.202,318.20

Low/High

2,315.102,338.20

Change

-17.10-0.73%

30daychg

-16.10-0.69%

1yearchg

+393.20+20.44%

Silver Price & PGMs

(Kitco News) – Gold prices will continue to enjoy the support of strong central bank buying even if China’s purchases slow, while both silver and gold could see lower Indian demand later this year, according to precious metals strategists at Heraeus.

In their latest precious metals report, the analysts wrote that they expect strong central bank demand for gold to continue.

“A recent survey by the World Gold Council showed that the majority of the 70 central banks surveyed indicated a preference to increase gold purchasing and reduce dollar holdings over the next five years, although only 29% expected their institutions to increase gold reserves within the next 12 months,” they said. “Interest rate levels, inflation concerns and geopolitical instability are ranked as the top three drivers behind reserve management decisions. Data shows that net central bank purchases in the year to April reached 110.5 tonnes, largely in line with the past two years.”

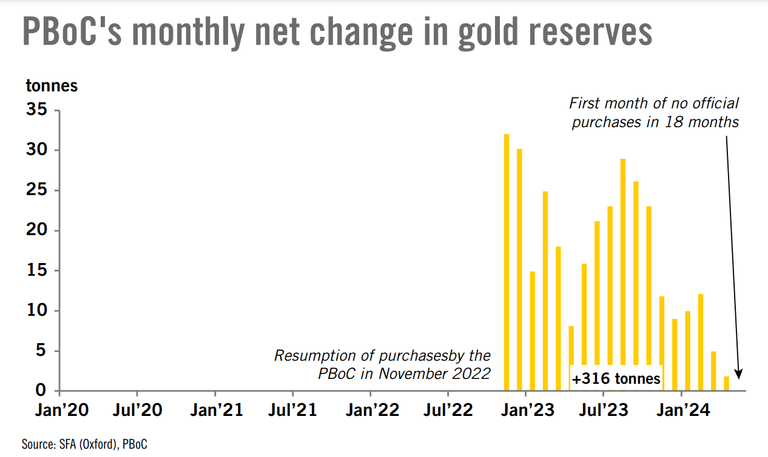

Heraeus also noted the pause on gold purchases by the People’s Bank of China (PBoC) in May after 18 consecutive months of net inflows. “However, a lack of reported additions to Chinese central bank gold holdings does not necessarily mean that official holdings in other institutions (e.g. sovereign wealth funds) have halted,” they said. “For example, the reported increase in gold holdings of 604 tonnes in June 2015 was the result of a transfer of metal built up over time into PBoC reserves, rather than one large on-the-market purchase. It is possible, therefore, that the PBoC is still accumulating gold behind the scenes.”

Even accounting for a slowdown in purchases by the PBoC, global central banks are projected to buy 273.7 tonnes of gold this year, the analysts wrote. “If central bank purchases continue robustly, as implied by the survey, they could offer demand support over the next five years.”

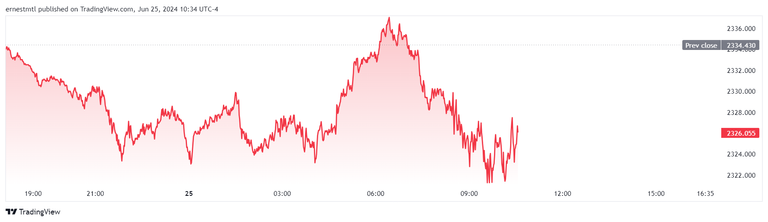

After Friday’s sharp drop from a high of $2,367.70 to beow $2,320 per ounce, spot gold has traded in a narrow $15 range to start the week, last trading at $2,326.05 per ounce on Tuesday for a loss of 0.35% on the day.

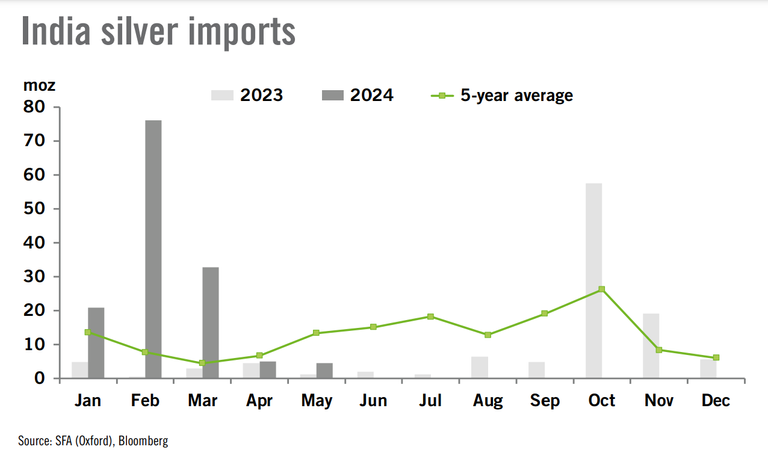

Turning to silver, the analysts warned that a delayed monsoon season in India may lower demand for precious metals later this year.

“India has witnessed 20% less rainfall since the beginning of June than typical, according to the India Meteorological Department, and the seasonal arrival of the monsoon is approximately two weeks behind schedule,” Heraeus noted. “Rainfall during the monsoon season is important to India’s agricultural sector, and delays to its arrival could negatively impact crop yields at the autumn harvest, with a knock-on effect for rural incomes. Rural communities are an important buyer of precious metals.”

According to The Silver Institute, India accounted for 3,771 tonnes of silver demand in jewelry and silverware in 2023, representing 46.9% of global demand in those sectors.

“If rural disposable incomes are negatively impacted, silverware and silver jewellery demand could be hit, as well as demand for gold,” the analysts wrote. “If Indian silverware fabrication declines by 10% this year, demand is at risk of falling below 1,000 tonnes for the first time in three years. Year-to-date, silver imports by India have been relatively strong, having already reached 4,335 tonnes, representing a 77.6% increase year-on-year, which could mean that even with a slowdown in H2 ’24, year-on-year imports may be in line with those in 2023.”

After following gold prices lower on Friday, silver has come under pressure once again in Tuesday trading, with spot silver falling from $29.618 per ounce just after 8:30 am EDT to a session low of 29.118 an hour later. Spot silver last traded at $29.196 for a loss of 1.28% on the daily chart.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com