SPOT MARKET IS OPEN (WILL CLOSE IN 3 HRS. 37 MINS. )

Live Spot Gold

Bid/Ask

2,326.102,327.10

Low/High

2,314.702,353.20

Change

-24.40-1.04%

30daychg

+24.90+1.08%

1yearchg

+367.80+18.78%

Silver Price & PGMs

(Kitco News, Tues. June 4th, 2024) – While gross gold purchases were similar to those seen in March, sovereign selling dried up in April, resulting in a large net gain by central banks, according to Krishan Gopaul, Senior Analyst, EMEA at the World Gold Council.

“The rapid rise in the gold price during March raised several questions,” Gopaul noted in their latest report. “One of these was whether central banks – whose demand has been posited as a key reason for the recent rally – would change their gold buying behaviour in response.”

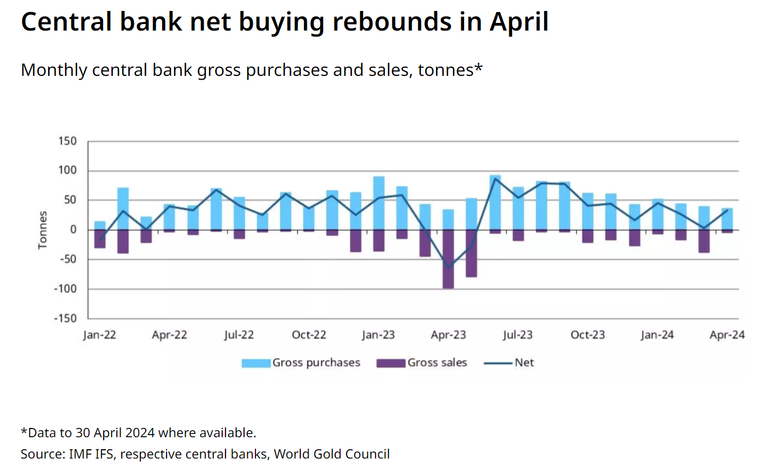

Gopaul said that March’s more complete data, combined with initial numbers for April, show that the sovereign appetite for bullion is as strong as ever. “Latest figures – reported via the IMF and publicly available sources – show that global gold reserves rose by a net 33t in April, similar to levels seen in February (27t). Although gross purchases dipped to 36t, from 39t in March, gross sales saw a more pronounced m/m drop from 36t to just 3t in April.”

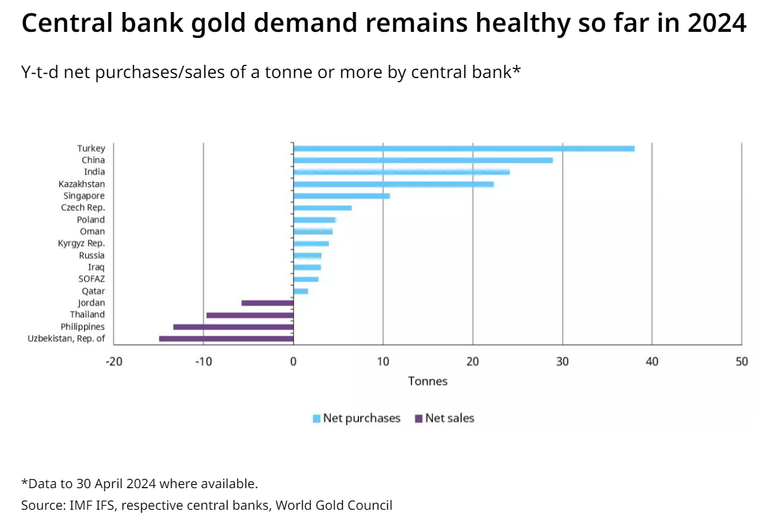

The latest numbers show that eight central banks increased their gold reserves by one tonne or more during the month. “The Central Bank of Turkey was the largest buyer, increasing its official reserves by 8t,” Gopaul said. “With 11 consecutive months of buying, the bank’s y-t-d net purchases now total 38t and lift its total official gold holdings to 578t.”

The other major buyers during the period were the National Bank of Kazakhstan (6t), the Reserve Bank of India (6t), the National Bank of Poland (5t), the Monetary Authority of Singapore (4t), the Central Bank of Russia (3t), and the Czech National Bank (2t).

Notably, the data did show a significant slowdown in gold buying by the People’s Bank of China. “The bank reported that its gold reserves rose by just under 2t in April to 2,264t – the lowest monthly increase since it resumed reporting in November 2022 and well below the 18t monthly average prior to April,” he wrote.

The only significant sales in April were from the Central Banks of Uzbekistan and Jordan. “Both reported a 1t decline in their gold reserves, a notable reduction in the pace of selling seen in February and March,” Gopaul said.

March also saw significant revisions, as “net purchases for the month have been revised to just 3t following the late reporting of a 12t sale by the Central Bank of the Philippines,” Gopaul noted. “While gross purchases during March were relatively stable in the face of the rapidly rising gold price, gross sales saw a marked pick-up thanks to heavy sales from (now) four banks,” the others being Uzbekistan (11t), Thailand (10t), and Jordan (4t).

“This suggests that price performance may well have had some impact on the activity of some central banks,” he said.

Gopaul said that the preliminary April data suggests that the March numbers may have been an outlier and that central banks may be continuing with their bullion accumulation plans in the face of high prices.

“Of course, more data for April, as it becomes available, as well as data for May, will be instructive to further assess how central banks’ approach to gold purchases will evolve,” Gopaul concluded. “In addition, June sees the publication of findings from our Central Bank

Gold Survey 2024, which will provide a rich insight into central banks’ thinking towards gold, and how this may influence gold buying going forward.”

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC