Live Spot Gold

Bid/Ask

2,670.202,671.20

Low/High

N2,655.402,679.10

Change

+7.10+0.27%

30daychg

-23.90-0.89%

1yearchg

+648.80+32.09%

Silver Price & PGMs

Goldman Sachs Group Inc. announced on Sunday that it no longer expects the gold price to reach $3,000 per ounce by the end of 2025, with the Federal Reserve’s shallower rate cut path pushing the forecast to mid-2026.

Goldman analysts, including Lina Thomas and Daan Struyven, wrote in the update that slower monetary easing will likely depress demand for gold-backed exchange-traded funds (ETF) in 2025. They now project the spot price to top out at $2,910 per ounce by the fourth quarter. The analysts added that weaker-than-expected ETF flows in December driven by easing uncertainty after the US election also resulted in a lower starting point for gold prices into the new year.

“Opposing forces — lower speculative demand and structurally higher central bank buying — have effectively offset each other, keeping gold prices range-bound over the past few months,” the analysts wrote, but added that demand from central banks will remain a key driver for prices over the longer-term. “Looking ahead, we forecast monthly purchases to average 38 tons through mid-2026.”

Goldman’s economists now expect 75 basis points of interest rate cuts this year, down from their previous prediction of 100 basis points. The updated forecast is still more dovish than current market pricing, as the bank sees underlying inflation trending lower.

The analysts also said they were doubtful that the incoming Trump administration’s policies will necessarily lead to higher interest rates.

As recently as Nov. 18, commodity analysts at Goldman Sachs were sticking to their guns on gold prices hitting $3,000 per ounce by the end of 2025.

Even after Donald Trump’s election victory and a Republican Party sweep through Congress triggered a wave of selling and profit-taking in the gold market, the investment bank said that the factors driving gold to record highs have not disappeared.

“The structural driver of the forecast is higher demand from central banks, while a cyclical lift would come from flows to exchange-traded funds as the Federal Reserve cuts,” the analysts said in a note at the time.

The analysts said they expected central bank demand to remain strong for the foreseeable future as nations continue to diversify their official reserves away from the U.S. dollar.

Goldman Sachs also noted that the U.S. government’s growing debt could prompt more central banks to increase their gold holdings.

While Trump’s election win and proposed ‘America-First’ policies pushed bond yields and the U.S. dollar higher, creating significant headwinds for the yellow metal, Goldman Sachs said these policies could also support gold prices through 2025.

“An unprecedented escalation of trade tensions could revive speculative positioning in gold,” the analysts said.

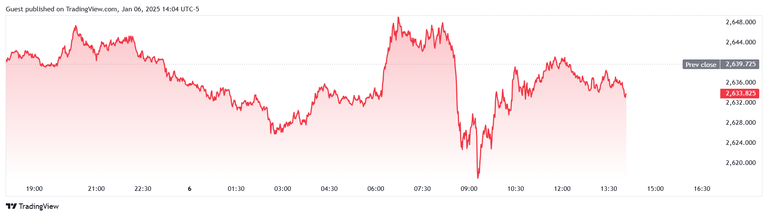

Gold has seen a high degree of price volatility on Monday, with spot gold spiking as high as $2,649.52 per ounce at 6:45 am EST before falling to a session-low $2,614.63 by 9:15 am.

Spot gold last traded at $2,633.89 per ounce for a loss of 0.22% on the daily chart.

Posted by:

Jack Dempsey, President

401 Gold Consultants LLC

jdemp2003@gmail.com